Economic Breakdown of a Copper Wire Manufacturing Plant: A Detailed Cost Model

What is Copper Wire?

Copper wire is a versatile, flexible, and highly conductive electrical wire used extensively in power transmission, telecommunications, and electronics. Fabricated from pure copper, copper wire has good thermal and electrical conductivity, resistance to corrosion, and ease of processing.

Key Applications Across Industries:

Copper wire plays a critical role in construction, automotive, and consumer electronics industries. With the increased demand for effective power distribution and advancing technology, the copper wire market keeps growing because of urbanization, electrification, and growth in infrastructure development globally.

What the Expert Says: Market Overview & Growth Drivers

According to an IMARC study, the global copper wire market reached 21.6 Million Tons in 2024. Looking ahead, the market is expected to grow at a CAGR of approximately 5.0% from 2025 to 2033, reaching a projected size of 33.6 Million Tons by 2033. The copper wire industry is influenced by a number of prominent factors. Rising demand for electricity, urbanization, and the fast pace of infrastructure development are the principal growth drivers.

The high conductivity and durability of copper wire make it a must-have for power transmission, electrical wiring, and machinery in industry. The growing use of electric vehicles (EVs) and renewable energy systems, including solar and wind power, also drives demand. Besides, growth of the telecommunications market, including data centers and 5G networks, propels demand for copper wiring with high performance. Demand from consumer electronics and the building sector also takes a substantial bite. Electrification and smart grid promotion through government programs fast-track market growth further. On the flip side, raw material price volatility and the development of aluminum as a substitute threaten challenges. In spite of this, the expanding emphasis on energy efficiency and sustainability keeps stimulating innovation and demand for copper wire.

Case Study on Cost Model of Copper Wire Manufacturing Plant:

Objective

One of our clients has approached us to conduct a feasibility study for establishing a mid to large-scale copper wire manufacturing plant in United States.

IMARC Approach: Comprehensive Financial Feasibility

We have developed a detailed financial model for the plant's setup and operations. The proposed facility is designed with an annual production capacity of 2,629 tons.

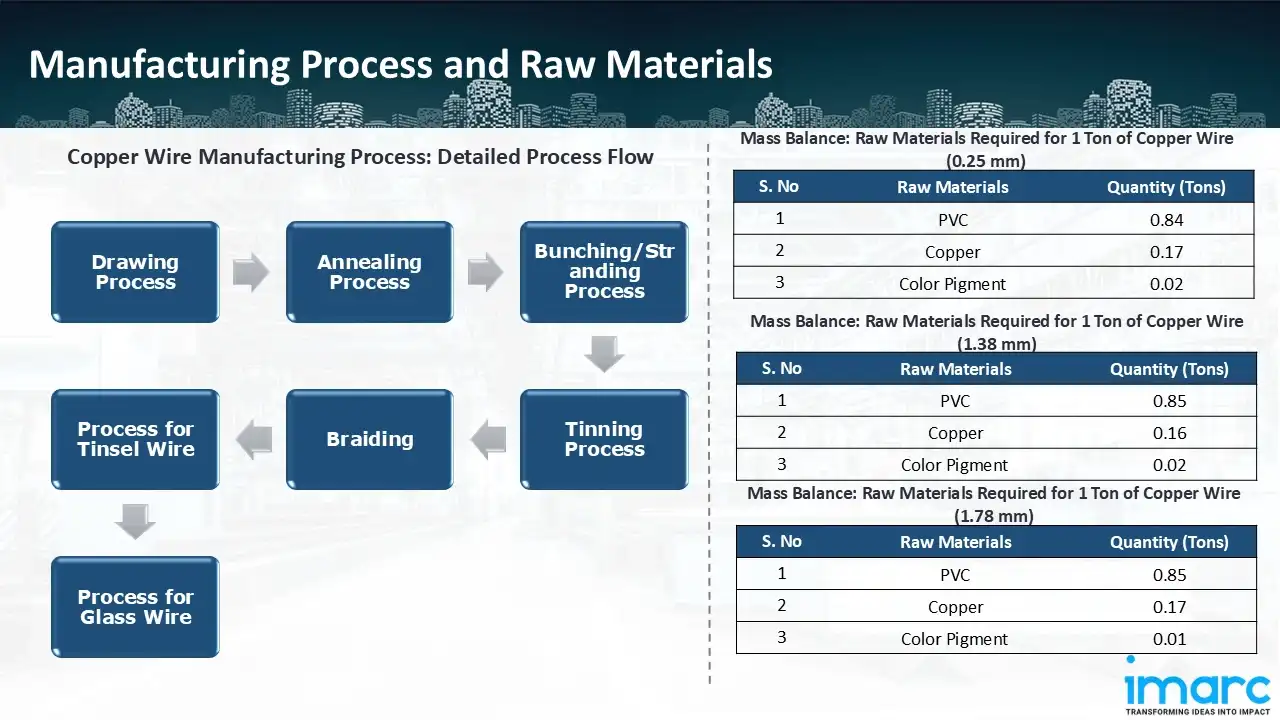

Manufacturing Process: Copper wire is produced using a number of crucial procedures to guarantee its excellent conductivity and robustness. The first step in the drawing process is to reduce the diameter of copper rods by pulling them through a series of dies. This procedure increases the wire's pliability and strength. To increase electrical conductivity and restore ductility, the drawn wire is then heated in a controlled atmosphere during the annealing process. The bunching/stranding method increases flexibility and endurance by twisting several thin copper wires together to create stranded wire. To increase corrosion resistance in specific applications, a thin layer of tin is applied to copper wire during the tinning process. Fine copper wires are woven together in the braiding process to strengthen electrical lines mechanically and provide shielding. In order to provide flexibility for specific applications, copper strands are wrapped around a textile core in the tinsel wire process. For resistance to high temperatures, copper wire is wrapped or coated with glass fibres using the glass wire technique. Lastly, before being packaged and distributed, the wires go through a comprehensive quality check.

Get a Tailored Feasibility Report for Your Project Request Sample

Mass Balance and Raw Material Required: The primary raw materials utilized in the copper wire manufacturing plant include PVC, copper, and color pigment. To produce 1 ton of copper wire (0.25 mm), we require 0.84 ton of PVC, 0.17 ton of copper, and 0.02 ton of color pigment. To produce 1 ton of copper wire (1.38 mm), we require 0.85 ton of PVC, 0.16 ton of copper, and 0.02 ton of color pigment. To produce 1 ton of copper wire (1.78 mm), we require 0.85 ton of PVC, 0.17 ton of copper, and 0.01 ton of color pigment.

List of Machinery:

The following equipment was required for the proposed plant:

- Rod Breakdown Line

- High Speed Insulation Line

- Multi-wire Drawing Line

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

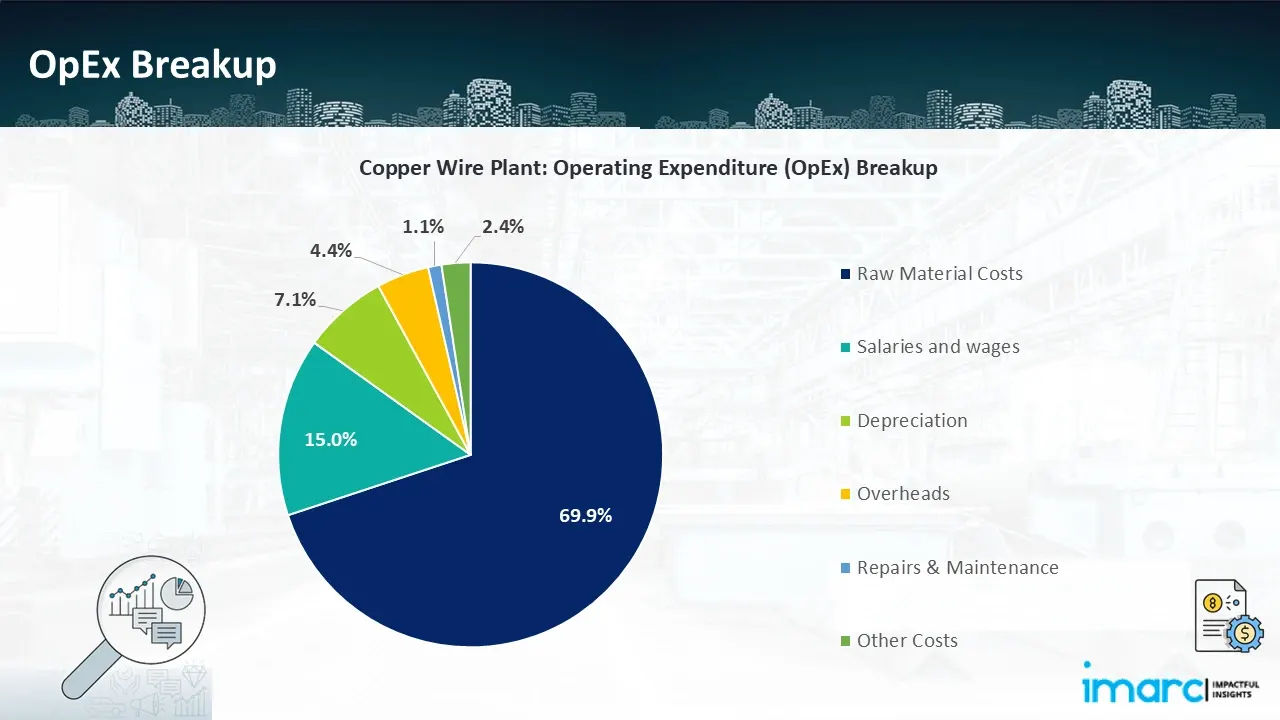

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. OpEx in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

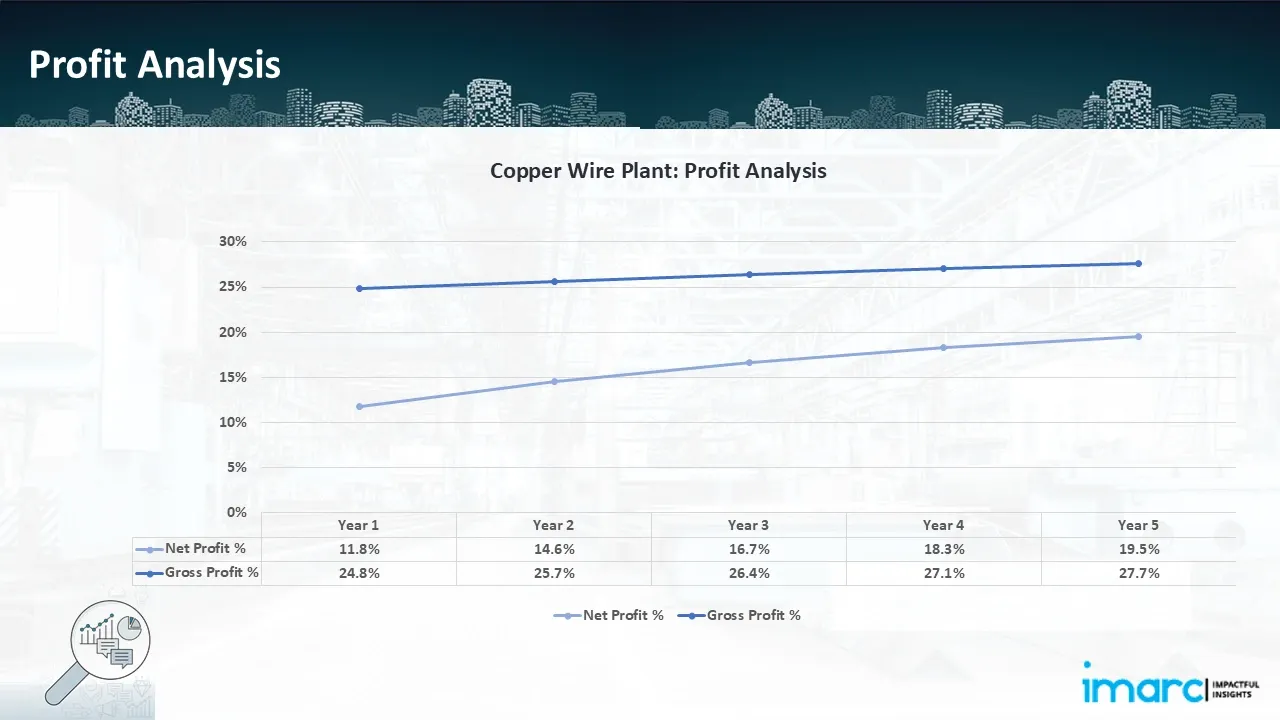

- Profitability Analysis Year on Year Basis: The proposed copper wire plant, with an annual capacity of 2,629 tons of copper wire, achieved an impressive revenue of USD 14.4 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit improved from 24.8% to 27.7%, and net profit rise from 11.8% to 19.5%, highlighting strong financial viability and operational efficiency.

Conclusion & IMARC's Impact:

Our copper wire manufacturing plant's financial model was meticulously modelled to satisfy the client's requirements. It provided a thorough analysis of production costs including capital expenditures, manufacturing processes, raw materials, and operating costs. The model predicts profitability while accounting for market trends, inflation, and any shifts in the price of raw materials. It was created especially to satisfy the demand of producing 2,629 tons of copper wire annually. Our commitment to offering precise, client-cantered solutions that ensure the long-term success of significant industrial projects by giving the client useful data for strategic decision-making is demonstrated by this comprehensive financial model.

Latest News and Developments:

- In January 2025, Rio Tinto and Glencore held merger talks, which could lead to one of the largest consolidations in the global mining sector. Should the deal go through, it would unite two of the largest commodities companies, bolstering their holdings in copper, iron ore, and other vital resources.

- In April 2024, Prysmian agreed to buy Texas-based Encore Wire for $4 Billion. The purpose of this calculated action is to increase Prysmian's market share in the United States, specifically in the building industry sector.

- In February 2023, Nexans and KGHM have signed a significant agreement for the supply of copper cathodes in 2023–2027. According to the deal, around 22.8 thousand to over 27.8 thousand tonnes of cathodes will be delivered annually.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Brief List of Our Services: Market Entry and Expansion

- Market Entry and Opportunity Assessment

- Competitive Intelligence and Benchmarking

- Procurement Research

- Pricing and Cost Research

- Sourcing

- Distribution Partner Identification

- Contract Manufacturer Identification

- Regulatory Approvals, and Licensing

- Factory Setup

- Factory Auditing

- Company Incorporation

- Incubation Services

- Recruitment Services

- Marketing and Sales

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104